The market is rife with the reports of Korean phone-maker Samsung intending to acquire Blackberry for $7.5 billion, in spite of both the companies labelling the reports “groundless”. The speculation sent the Canadian smart-phone maker’s stock soaring 30% before it fell down by 17%. The possibility of the acquisition has raised a very important question- What makes Blackberry so appealing to Samsung?

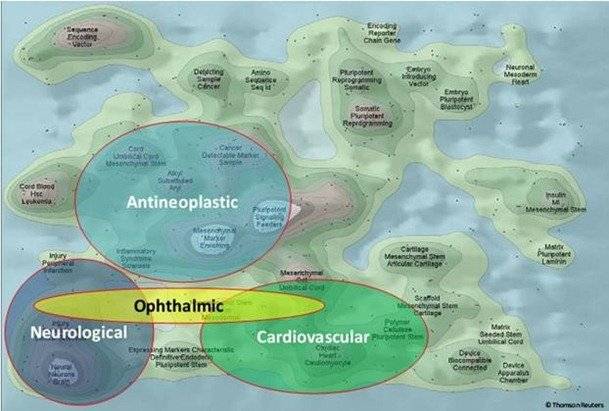

The acquisition would give Samsung the access to Blackberry’s robust patent portfolio that includes 44,000 patents worth over $1.43 billion. These patents cover security, business to business sector and Blackberry’s car entertainment software, giving an edge to Samsung to further its battle with Apple and others. As Blackberry management is not interested in selling specific assets, Samsung would be required to bid for the entire company. The company has declined a few takeover proposals from potential buyers including Intel, Google and Lenovo in the last few months. The BlackBerry board is assumed to believe that a restructure will deliver better value than an acquisition. A couple of months ago, in a first of its kind partnership among competitors working on a major product, Blackberry teamed up with Samsung for a management-services partnership..

In case Blackberry and Samsung decide to go ahead with the deal, they will require consent of the Canadian Government. Canada re-evaluates the foreign acquisitions worth over $296 million to find out if the deal is beneficial to the country. The government also assesses the deals on considerations related to national security. Canadian Minister of Finance, Mr. Joe Oliver, refrained from commenting on government’s stand on the potential deal.

The deal will provide a major boost to Samsung as it competes with Apple’s new iPhones and Chinese makers including Xiaomi Corp. and Huawei Technologies Co. in the mid-segment. As Samsung acquires more standalone non-Android software components, Google stands to lose the maximum as Samsung is its biggest market partner.

Image source here (Governed by Creative commons license CC by SA 3.0)