This post was first published on March 14th, 2013.

Contrary to popular belief in India, Intellectual Property (IP) is neither a boon nor a curse for small and medium enterprises (SMEs). Just like other business tools, it is a tool that can provide business and competitive advantage, provided an SME wishes to gain such an advantage. The wish must obviously be backed by appropriate steps in the right direction, in the light of the SMEs business goals. While the overarching objective of this series is to indicate various elements of the path to gaining business value, this article will focus only on the macro level role of IP.

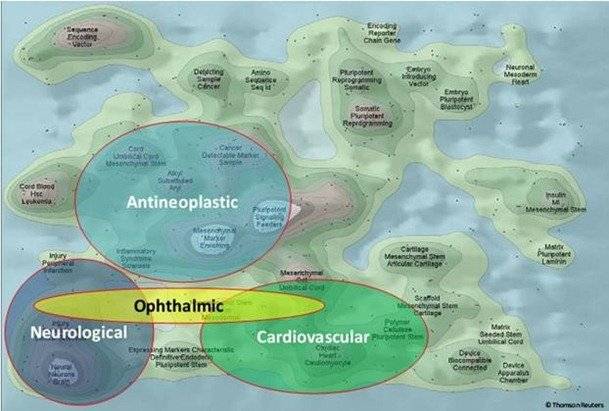

When viewed through the eyes of a bird, the IP map for an SME shows well-defined mounds and white spaces. While the mounds are danger zones, white spaces are both free zones and opportunities.

An SME must stay away from the mounds and can, if it chooses, take advantage of the white spaces. In other words, every SME must mitigate risks that spring from others’ IP and may consider building business value from its own IP.

Intellectual Property, if used in the right manner, can provide the following advantages, among others:

· Market Exclusivity;

· Financial Value;

· Raising Investment;

· Marketing/Business Development; and

· Licensing Revenues.

Market Exclusivity

Exclusivity is a natural outcome of IP protection. Intellectual property grants exclusive rights, which translates to market exclusivity with respect to its subject matter, thereby contributing to a company’s business and competitive advantage. Having said that, market exclusivity, except under rare circumstances, is only relative and not absolute. To elucidate this with the help of an example, if a company gets a patent over a flexible cloth hanger, the company will not be able to stop competitors from selling cloth hangers completely. It will be able to prevent others, only from selling flexible cloth hangers that fall within the scope of the patent. It will not be able to prevent the sale of pre-existing hangers and hangers that follow a different mechanism. Also, the extent of market exclusivity will depend on the number of already existing products and patents with respect to hangers. So, exclusivity provided by a patent is absolute, but from the market perspective, it is only relative.

Financial Value

In an IP savvy SME, a major chunk of the financial value of the organization springs from its intellectual assets. The ideal ratio of intellectual assets to tangible assets, in an innovative/creative company, is at least 10:1. But unfortunately, the value of intellectual assets in most innovative, Indian SMEs, offering products or services, is today less than ten percent of their total asset value. Lack of awareness, inability to adapt to changing the market environment and lack of confidence in the IP system, are among the primary reasons for the low value.

Having said that, many companies are today built and are gearing up to build quality IP portfolios that can provide high financial value. A company based out of Bangalore, Ducom, which focuses on friction engineering has filed patents on products relating to tribology. Another company, also based out of Bangalore, UCAM, which focuses on CNC machines is building a patent portfolio with respect to innovative machines. The primary objective of these companies is to build the business and its financial value based on their patent assets.

Raising Investment

Intellectual Property has since long been proving to be a valuable asset for raising funds. Either a company is publicly listed or just starting, IP has been playing and continues to play a role in attracting investors. Exclusivity through IP helps companies build, retain and grow business and is thereby an attractive proposition for investors. Furthermore, analysis of IP and the value it can provide forms an integral part of most investors’ assessment criteria.

Marketing/Business Development

For lack of other reliable indicators and intellectual property’s direct relationship with innovative and creative activity, IP is viewed by scholars, businesses, and consumers as an indicator of a company’s inventive and creative capability. IP, therefore, becomes an important tool in selling the business story of an innovative company to prospective customers. Most multi-national corporations and large companies, respect and value IP highly, and are therefore impressed if an SME showcases its IP assets effectively. Not only companies, even consumers associate IP protection to product quality, making it an invaluable marketing tool to sell novel products.

Licensing Revenues

IP, if built strategically, can generate revenues through license deals. Whether a company is using its IP in its business or not, licensing could be a good opportunity to not only earn money but also penetrate alien markets. For example, if an SME has established itself in south India and does not have access to the north Indian market, it can consider licensing its IP to a company that is established there. The same logic may be applied to reach out to foreign markets.

Most organizations assume that having IP is a natural pre-cursor to licensing deals, but that is not often true. For striking a licensing deal, having IP is not enough, the IP must have sufficient strength to prevent competitors, must have business value and must have takers. Normally, it is easy to license a portfolio of IP around a product, rather than a single patent or trademark.

Many SMEs have been successful in licensing and building joint ventures based on IP.

Risk Assessment

Though quite a few companies realize the value of IP and focus on building an IP portfolio, many of them fail to give due importance to risk assessment. The apathy stems from lack of awareness and deficiencies in the legal/enforcement system, among others. While it is true that risks from IP of third parties are today not as ominous in India when compared to developed markets, the systems have changed substantially since 2005 and are expected to transform in the next few years. Even today, there are multiple stories of companies being driven out of business or paying huge monetary damages due to IP infringement.

Under the said circumstances, an SME looking to gain value from IP must also beware of risk from IP of others. Taking risk mitigation steps like the freedom to operate analysis, risk clearance searches and so on can go a long way in maintaining businesses and preventing losses.

Quality IP is the key

The word quality has different connotations in different contexts and is considered to be one of the highly misused terms, owing to its subjective nature. Despite that, this term has been used quite liberally in this text and an attempt has been made to explain its interpretation, as perceived by the author. In the context of the value of IP for businesses in general and SMEs in particular, quality IP refers to Intellectual Property that has business value and has very few or no alternatives. In other words, this IP has the potential to stop competitors from easily designing around it.

Though all forms of IP are assessed on common business parameters at the macro level, the quality of each type of IP is assessed based on different factors. If the IP in question is a patent, its quality depends on the scope and strength of its claims, the number of alternative options that are possible or available, possibility of designing around and so on. On the other hand, for a trademark, its quality depends on factors such as nature of the mark, use of similar marks nationally or internationally for similar businesses, consumer recognition and so on.

To sum up, the quality of IP is directly proportional to the value it can provide for business. The greater its value, the higher the value it can provide and vice versa. It is, therefore, logical to conclude that SMEs can derive value from their intellectual assets only if they can build a portfolio of quality IP, which can provide real, rather than perceived, value.