This post was first published on 19th May, 2014.

Evergreening, known in the politically-correct-circles as “Life Cycle management” of a drug, is the concept of extending the exclusivity term rendered to a pharmaceutical patent through legal and business measures. Contrary to existing myths and notions, Evergreening does not stop an interested party from exploiting the invention of an expiring patent. It is purely a business strategy to introduce and position newer products (sometimes patented) into the market so as to prolong consumer interest, before the generic players flood the market.

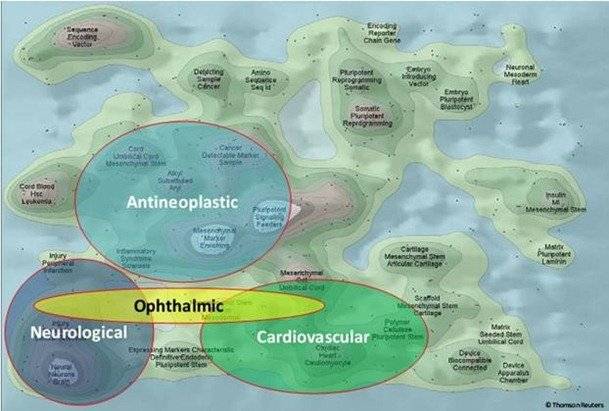

After the expiry of the term of exclusivity granted to a drug (could be patent exclusivity or data exclusivity provided by the drug regulatory body), the owner of the drug is forced to bring down the pricing of the drug from monopoly pricing to match the competitive pricing offered by generic players. Evergreening is a business strategy adopted by patent owners of successful drugs (read as block busters), using which they file patents for incremental inventions around the base patent i.e., the original patent claiming the active ingredient. An incremental invention may be directed towards a new form, new use, new formulation, new dosage variant or new combinations of the active ingredient in the base patent. They are filed at strategic intervals to ensure that even after the base patent expires there is some remnant exclusivity that the patent holder can enjoy for a few more years. Moreover, it is a strategy, which, if adopted by a pharmaceutical company, allows it to price the repositioned version of the expiring drug (sold at monopoly price during the patent term) at a higher price than competitive market price. Furthermore, marketing and launching efforts emphasizing the additional benefits of the repositioned drug allows a company to increase demand for the product, thus justifying the increase in price.

Most pharmaceutical companies rely on Evergreening strategies for their successful drugs. For example, the patent for Nexavar (trade name for Sorafenib), an anticancer drug proprietary to Bayer, was filed in the year 2000. This patent is due to expire in early 2020. However, Bayer has filed multiple patents following the base patent for the active ingredient of Nexavar, the recently published one being a patent claiming a method of treatment of a specific type of cancer by administering effective amounts of Sorafenib, filed in 2012 (estimated expiry in 2032). Bayer positioned Sorafenib for treating advanced renal cell carcinoma in 2005, hepatocellular carcinoma in 2007 and has an ongoing phase-3 clinical trial for thyroid cancer that began in January 2013. Bayer’s product pipeline designed around Sorafenib indicates that Bayer has been “managing the life cycle” of Nexavar though several patents around the base drug to ensure that there is some remnant exclusivity at least for 2 decades even after the expiration of the base patent. Does this mean that through these strategies, Bayer will be able to stop others from making Nexavar even after 2020?

The answer is “NO”. Upon the expiry of Bayer’s patent which claims the use of Nexavar for treating advance renal carcinoma, the generic players can sell Nexavar for the treatment of renal cancer, but they can’t position it for the treatment of thyroid cancer, since Bayer’s patent for the use of Nexavar for the treatment of thyroid cancer will remain in force even after 2020.

Evergreening is like any other business strategy that market players would adopt to seek a competitive edge in the market. It doesn’t stop anyone from making the product claimed in the expired patent, but only makes sure that they can differentiate themselves from the other generic products through incremental inventions. More often than not, the R&D efforts and investments that go into the making of these incremental inventions can be very high and their results invaluable for treatment.

One of the rationales of the patent system is to incentivize innovation which is believed to lead to the progress in technology. A patent application is published 18 months after it is filed so as to ensure that the knowledge in the patent is made public for aspiring inventors to design around and build on it. Anyone, including the owner of an existing patent and their competitors, is free to invest in research in this direction as early as 18 months from the filing of such a patent. If a competitor files for an incremental patent, it is branded as innovation, but when a patent holder files for an incremental patent, it is looked upon as innovation leading to life cycle management or Evergreening.

In most parts of the world, life cycle management is considered as positive development. However, to the frustration of many pharmaceutical companies, symbolically represented by Bayer, life cycle management is quite a tricky business in India, thanks to the infamous Section 3(d) of the Indian Patent Act, often alluded to as the anti-evergreening law, which bears the burden of keeping a check on incremental pharmaceutical inventions that add no therapeutic value. Section 3(d) states that “the mere discovery of a new form of a known substance which does not result in the enhancement of the known efficacy of that substance, or the mere discovery of any new property or new use for a known substance or of the mere use of a known process, machine or apparatus, unless such known process results in a new product or employs at least one new reactant” is not patentable.

In the explanation to this section the Act explicitly mentions that salts, esters, ethers, polymorphs, metabolites, pure form, particle size, isomers, mixtures of isomers, complexes, combinations and other derivatives of a known substance shall be considered to be the same substance, unless they differ significantly in properties with regard to efficacy. Section 3(d) necessarily prohibits the allowance of a patent for a pharmaceutical incremental invention, unless such improvement shows enhanced efficacy.

Through the Gleevac case, the Supreme Court gave life to this piece of law, making India’s stand on incremental inventions reasonably clear. The Supreme Court upheld the decision of the Indian Patent Office to reject a patent for a beta-crystalline form of Imatinib Mesylate filed by Novartis as it failed to show enhanced therapeutic efficacy.

Via the 2014 Special 301 Report of the USTR, the US has expressed concerns that Section 3(d), as interpreted, may have the effect of limiting the patentability of potentially beneficial innovation. Such innovation would include drugs with fewer side effects, decreased toxicity, improved delivery systems or temperature / storage stability. In practice, this standard has already been applied to deny patent protection to potentially beneficial innovations, some of which enjoy patent protection in multiple other jurisdictions.

In this series of posts, I will endeavor to delve into select topics that are relevant to Section 3(d), some of them being:

• To what extent does Section 3(d) stop Evergreening?

• What does enhanced therapeutic efficacy really mean?

• Does Section 3(d) restrict patentability requirements in a manner that violates our obligations under TRIPS?

Image

0 Comments

AB Suraj

Vinita – thanks for explaining the industry use of “evergreening” or “layering”. Look forward to your further posts on the very relevant questions you have raised. Also, could you provide a sector-based explanation on the threshold of inventions. Could there be differing threshold levels of patentability for different sectors – for instance is it the same level for Pharma and the Auto sectors? While am sure you would address issues of “novelty” and “inventiveness” under TRIPs and related criteria, am unable to appreciate this general outcry against Section 3(d) – is it only because it seems to be “targeting” the Pharma sector? Are there provisions of the 3(d) kind in any other part of the globe? Many thanks for this post again!